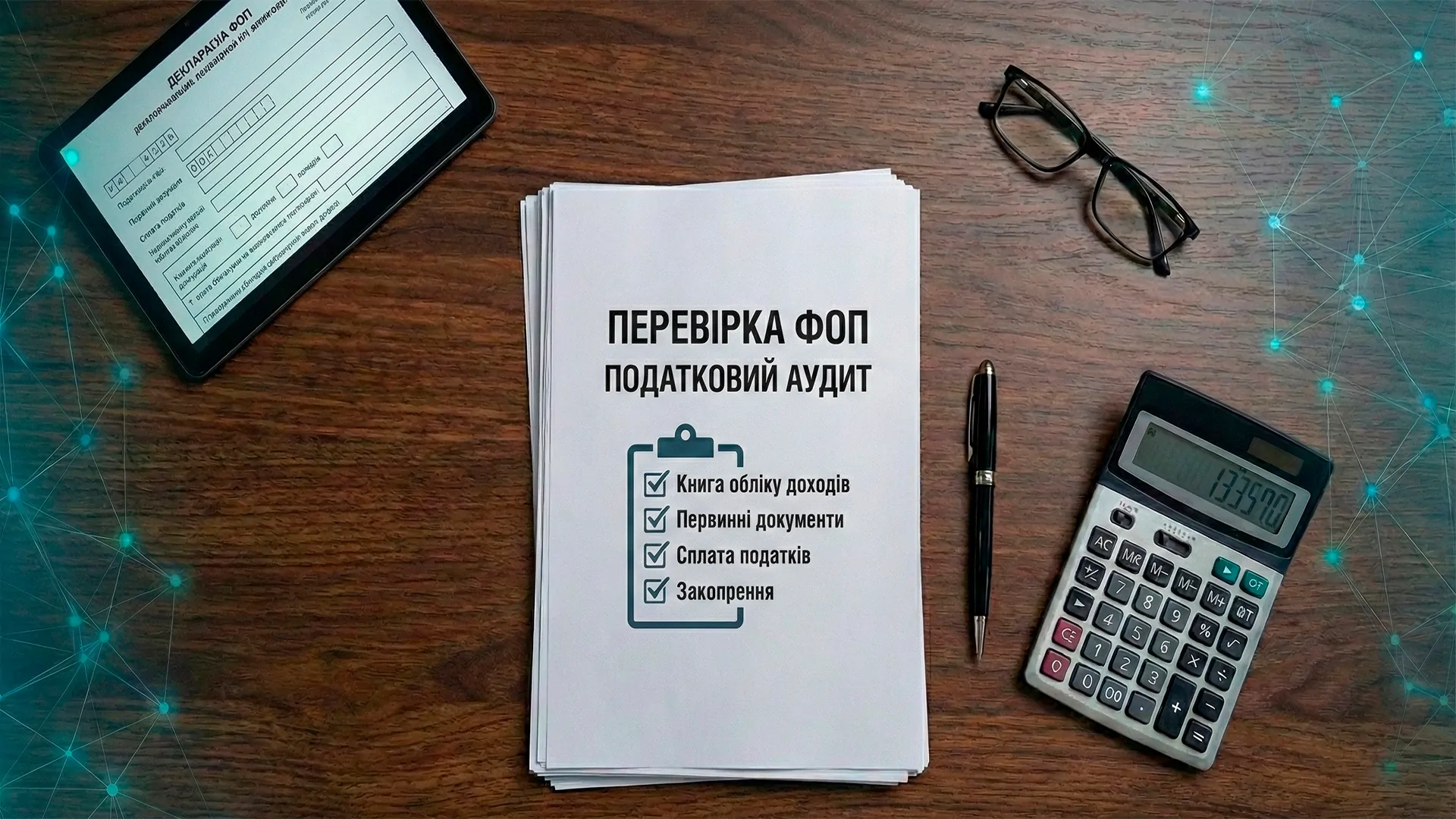

Individual Entrepreneur Tax Audit Support

Tax audit for an individual entrepreneur often becomes a serious challenge that can lead to significant tax assessments, fines and even criminal liability. Regardless of whether you work on single tax or general taxation system, professional legal support will help protect your rights, minimize financial losses and avoid unjustified claims from tax service.

What is Individual Entrepreneur Tax Audit and When Can It Be Appointed

Tax audit is a complex of control measures by the State Tax Service aimed at establishing data reliability submitted in tax reporting and compliance with tax legislation requirements. The legal basis is the Tax Code of Ukraine, particularly Section II.

Grounds for appointing individual entrepreneur audit may vary. Scheduled documentary audit is conducted according to annual plan-schedule approved by tax authority and published on official website. Each individual entrepreneur can check whether included in current year plan.

Unscheduled audit is appointed in cases: submission of clarifying calculation reducing monetary obligation amount, detection of submitted reporting data unreliability, tax authority receipt of violation information from other state bodies, untimely tax reporting submission.

Desk audit is conducted automatically after any declaration submission without special decision and without visit to individual entrepreneur’s business location. This is the most common control type that cannot be avoided.

Types of Individual Entrepreneur Tax Audits

Legislation provides three main tax audit types, each having its specifics and risk level for entrepreneur.

Desk audit is conducted at tax authority premises exclusively based on submitted declaration and documents appended to it. Individual entrepreneur may not even know they are being audited. Tax authorities analyze reporting indicators, compare them with counterparty data, verify calculation correctness. Audit period – from 30 days for VAT to end of next reporting period for other taxes.

Documentary audit involves inspector visit to individual entrepreneur’s business location or document research at tax premises. Auditors have right to demand primary documents, interview witnesses, inspect premises. Scheduled audit may last up to 10 working days for small enterprise and up to 20 days for medium. Unscheduled – up to 15 days.

Factual audit is conducted to establish presence at registration address, actual activity volume correspondence to declared, operating schedule compliance, cash register application. Such audits are often unexpected and last up to 10 days.

Individual Entrepreneur Rights and Obligations During Tax Audit

Knowing rights allows entrepreneur to effectively control audit process and defend against tax authority abuses.

Individual entrepreneur has right: to be present during audit, provide explanations and objections to auditor conclusions, familiarize with audit act and provide objections within 5 working days, appeal tax authority actions administratively or judicially, engage lawyer to protect interests at any audit stage.

Individual entrepreneur obligations during audit: present auditor certificates and audit direction, ensure business location access, provide documents related to audit subject, ensure workplace for inspectors, not obstruct lawful auditor actions.

Important to understand tax authority power limits. Inspectors have no right to demand documents unrelated to period or issues defined in audit direction, conduct audit without presenting certificate and direction, exceed established deadlines without lawful extension, seize document originals without compiling inventory.

Typical Tax Authority Violations During Individual Entrepreneur Audits

Unfortunately, tax authorities often commit procedure violations that may become grounds for audit result appeal.

Audit subject exceeding – inspectors often go beyond periods or issues defined in direction. For example, if allowed to check VAT for 2023, tax authority has no right to check profit tax or other periods.

Deadline violation – audit lasting longer than established period without proper extension is unlawful. Such audit act may be appealed.

Non-provision of familiarization and objection right – individual entrepreneur must receive audit act copy and have at least 5 working days for objection submission. If tax authority issued notice-decision earlier, this is procedural violation.

Demanding documents not provided by audit subject – inspectors sometimes demand documents unrelated to audit issues, creating entrepreneur pressure. Such demand can be appealed.

Using unreliable information – tax authorities often make conclusions based on counterparty data that is outdated, erroneous or not properly verified. Individual entrepreneur has right to refute such information documentarily.

What Documents Has Tax Authority Right to Demand From Individual Entrepreneur

Document volume that tax authority can request depends on audit type and subject.

During desk audit, tax authority has no right to demand additional documents except those mandatory declaration appendices according to legislation. Everything else is power exceeding.

During documentary audit, inspectors may demand: primary documents (contracts, invoices, acts, payment orders), accounting and tax record registers, financial reporting for audit period, documents confirming asset ownership, bank statements and fund movement documents, employment contracts and salary accrual documents.

Important: tax authority cannot demand documents for periods not covered by audit, personal documents unrelated to entrepreneurial activity, document originals for seizure without compiling inventory and seizure act.

If individual entrepreneur considers tax authority demand unjustified, has right to refuse with written reason substantiation. Lawyer will help assess demand lawfulness and formulate response.

Lawyer’s Role During Individual Entrepreneur Tax Audit

Professional lawyer support significantly increases chances of successful audit passage with minimal losses.

At audit preparation stage, lawyer analyzes audit direction for ground lawfulness and procedure compliance, checks tax reporting for potential risks, helps prepare documents and eliminate obvious deficiencies, instructs individual entrepreneur and employees about their rights and behavior tactics.

During audit conduct, specialist ensures presence at all auditor actions, controls procedure and deadline compliance, records tax authority violations, consults on inspector question responses, objects to unlawful demands and actions.

Upon audit act receipt, lawyer prepares substantiated objections referencing legislation norms, engages independent experts to refute tax conclusions, collects additional evidence favoring individual entrepreneur.

At notice-decision appeal stage, develops defense strategy, prepares complaint or statement of claim, represents interests in tax authorities and courts, seeks judicial examination appointment.

Supporting Individual Entrepreneur Tax Audit on Single Tax

Individual entrepreneurs on simplified taxation system have specific risks differing from general system.

Tax authority especially thoroughly verifies single tax status condition compliance: income volume not exceeding established limit (167 or 834 minimum wage sizes depending on group), hired employee number corresponds to limitations, activity types allowed for simplified system, absence of prohibited operations (goods import, mineral extraction etc.).

Most common claims to single tax individual entrepreneurs: concealing income portion through operation non-execution, income volume exceeding with subsequent general system transfer and tax assessments, working with legal entities permanently with relationship qualification as employment, improper hired employee execution or number exceeding.

Lawyer helps prove single tax status lawfulness, dispute relationship qualification as employment if civil-legal, refute income exceeding conclusions due to tax calculation errors.

Supporting Individual Entrepreneur Tax Audit on General System

Individual entrepreneurs on general taxation system face more complex audits due to detailed income and expense accounting necessity.

Main audit directions: expense classification as gross expense justification, primary document availability and execution correctness, VAT tax credit application lawfulness, unified social contribution accrual and payment rule compliance for hired employees.

Typical tax authority claims to individual entrepreneurs on general system: expenses showing personal consumption signs (housing rent, expensive cars, restaurants), working with shell company counterparties for artificial expense inflation, expense economic feasibility absence, expense non-correspondence to declared activity types, income and expense accounting book maintenance errors.

Key for successful defense is properly executed primary document availability confirming transaction reality: contracts with all essential conditions, cargo invoices or work completion acts, payment documents confirming payment, documents on goods/services receipt and use in activities.

Lawyer helps substantiate disputed expense economic feasibility, prove transaction reality even with counterparty problems, appeal tax position on expense qualification as personal consumption.

Tax Notice-Decision: How and Within What Periods to Appeal

Following audit results, tax authority issues tax notice-decision determining assessed tax, fine and penalty amount. This decision is not final and subject to appeal.

Appeal periods – 10 calendar days from notice-decision receipt date. Missing this deadline may lead to defense impossibility, so must act immediately.

Individual entrepreneur has two appeal paths: administrative (complaint to higher-level controlling authority) and judicial (claim to administrative court). Can choose one path or use administrative appeal first, then judicial.

Administrative appeal has advantage: automatically suspends notice-decision execution, gives time for additional argument preparation, may lead to dispute resolution without court. Complaint review period – 20 working days.

Judicial appeal requires professional preparation: statement of claim must contain detailed notice-decision illegality substantiation, must collect complete evidence base, important to correctly formulate claim demands and choose jurisdiction.

Effective appeal strategy includes procedural violation analysis, assessed amount calculation methodology appeal, judicial examination appointment, positive Supreme Court practice use.

Why Choose Dextra Law

Dextra Law legal company has many years’ experience supporting individual entrepreneur tax audits on all taxation systems. We know all tax service work nuances and can effectively protect entrepreneur interests.

Our advantages:

- Deep expertise in individual entrepreneur tax disputes – from single tax to VAT payer

- Prompt response – we understand entrepreneur time value

- Comprehensive support – from direction receipt moment to court decision execution

- Individual approach – each situation unique, no stereotypical solutions

- 98% of court cases end in our clients’ favor

If you were appointed tax audit, received audit act or notice-decision – don’t delay contacting lawyer. The earlier we begin protecting your interests, the more chances to avoid assessments or minimize them. Contact Dextra Law – we will protect your business!

Frequently Asked Questions

No, refusing lawfully appointed audit is impossible. Audit obstruction may lead to administrative liability. However, can control process and appeal unlawful tax actions.

Individual entrepreneur presence during documentary or factual audit is desirable but not mandatory. You can appoint authorized representative or lawyer. During desk audit your presence not required at all.

Scheduled documentary audit can be conducted no more than once per calendar year. However, desk audits conducted with each declaration submission, and unscheduled – with lawful grounds.

Must provide written response about document absence explaining reasons (lost, destroyed, never created). Primary document absence may lead to assessments, so better engage lawyer for consequence minimization.

Yes, individual entrepreneur can apply to tax authority with petition for objection submission period extension if objective reasons exist (need for additional document collection, examination conduct etc.). Decision made individually.

Administrative complaint filing automatically suspends notice-decision execution until review. During judicial appeal can petition for claim security as collection suspension.