Company Registration in the Special Legal Regime of DIYA CITY

Opening a company in Diya City is a step into the future, marking a new stage in business development in Ukraine. “Diya City” is defined not only as a digital resource but also as an innovative catalyst for creating and registering enterprises. It is a place where opportunities for entrepreneurs converge, ideas become a reality, and barriers for startups become smaller.

What are the advantages of a Diya City resident? What are the tax benefits?

Advantages of being a Diya City resident in Ukraine and tax incentives:

- Development and Innovation: Residency in Diya City provides access to an innovative environment where ideas can be exchanged, and collaboration with other technology companies is possible.

- Simplified Registration Process: Business registration for Diya City residents is streamlined and automated thanks to the use of electronic services.

- State Support: Residents have the opportunity to receive support from government agencies and authorities for the development of their innovative projects.

- No VAT on Export Services: Diya City participants benefit from a tax incentive exempting them from VAT on exported services.

- Simplified Tax Regime: Some residents may benefit from a simplified tax regime, which eases taxation and reporting.

- Income Tax Exemption: Some types of investments and income-generating operations are exempt from income tax.

- No Customs Restrictions: Residents enjoy certain advantages and the absence of customs restrictions for importing equipment and technology.

- Favorable Conditions for IT Specialists: Program participants can take advantage of favorable conditions for attracting and retaining highly qualified IT specialists.

Tax Benefits of Diya.City in Numbers for Comparison

We consider that the Unified Social Contribution (USC) from April 1, 2024, will be 1760.00 UAH.

*From March 1, 2022, and for 12 months after the end of martial law, sole proprietors voluntarily pay USC. It should be noted here that for the months when USC is not paid, the insurance record for such a person is not accrued. We take this into account in our calculations.

Since the minimum salary for an employee/gig-specialist resident of Diya.City should be no less than 1200 euros (approximate exchange rate of the NBU is 43.43 UAH per 1 euro), which is approximately 52,116.00 UAH, we take as an example a salary of 60,000 UAH and we get the following calculations:

Of course, the least amount of taxes is paid by sole proprietors of the 3rd group. The difference in taxes between a sole proprietor of the 3rd group and a resident of Diya.City is: 5,660.00 UAH (resident taxes) – 4,760.00 UAH (sole proprietor taxes) = 900.00 UAH.

The difference is insignificant, but with a staff of employees, it becomes a significant amount, you might say. And you would be right. However, consider the administration of each sole proprietor (accountants, lawyers, – preparation of reports and acts) and take into account the risks of recognizing the interaction with the sole proprietor as employment relations, and the picture becomes quite optimistic, even if you need to hire a personnel employee.

Also, remember that one of the criteria for recognizing an enterprise as critically important for the economy during a special period is the residency in Diya.City.

| Organizational Forms of Activity | Taxes from the Salary of 1 Employee |

| Sole Proprietor, LLC 3rd Group | Unified tax 5% from the income of 60,000.00 UAH – 3,000.00 UAH USC – 22% of the minimum salary – 1760.00 UAH60,000.00 – 3,000.00 – 1760.00 = 55,240.00 UAHThus, the amount of taxes is 4,760.00 UAH |

| LLC on the General System | USC – 22% – 13,200.00 UAH Personal Income Tax – 18% – 10,800.00 UAH Military Tax – 1.5% – 900.00 UAH60,000 – 13,200 – 10,800 – 900 = 35,100.00 UAH (employee receives “net”)Thus, the amount of taxes and contributions is 24,900.00 UAH |

| Resident of Diya.City | USC – 22% of the minimum salary – 1760.00 UAH Personal Income Tax – 5% – 3,000.00 UAH Military Tax – 1.5% – 900.00 UAH60,000 – 1760 – 3,000 – 900 = 54,340.00 UAH (employee receives “net”)Thus, the amount of taxes and contributions is 5,660.00 UAH. |

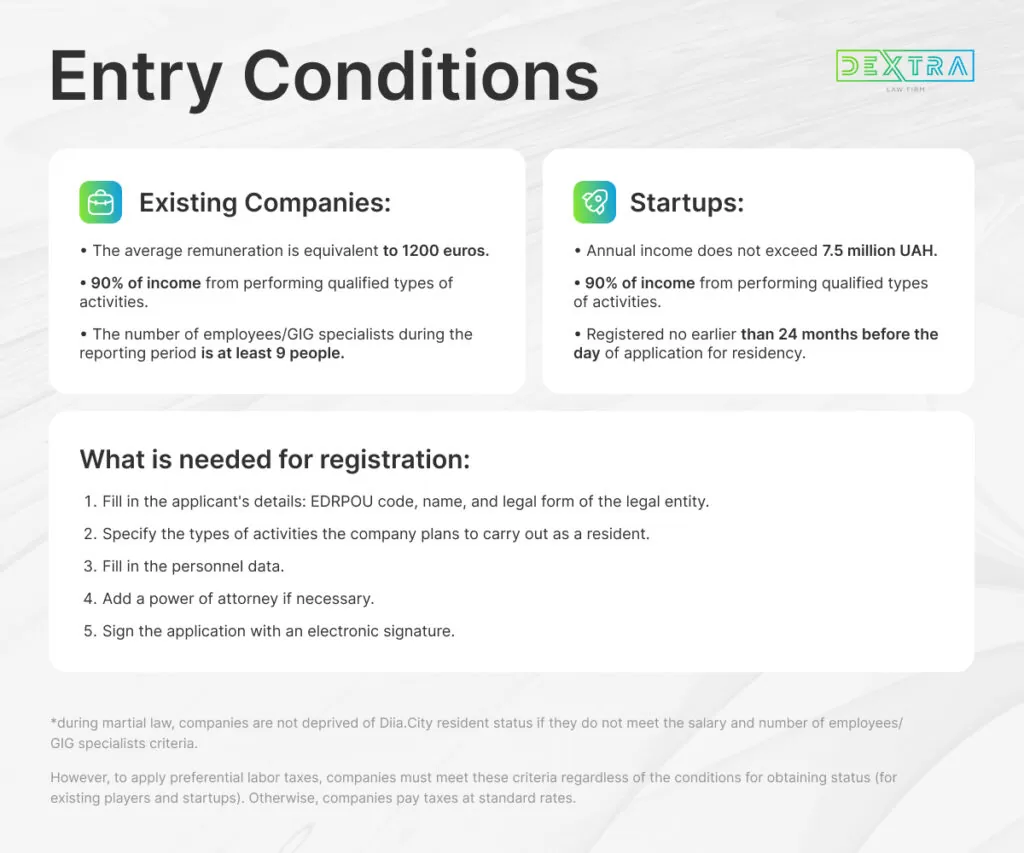

Who can become a participant in the program?

Various entities can become participants in the “Diya City” program, including:

- Businesses of any type and size seeking support for development and innovation.

- Startups – young and promising companies just starting their journey and in need of support.

- Professionals in the field of information technology looking to join innovative projects and initiatives.

- Organizations involved in research and development can participate in support programs.

- Individuals running their own businesses and aiming to develop them in a favorable innovation environment.

- Institutions engaged in research and educational projects.

Specific conditions and criteria for becoming a “Diya City” participant may vary depending on specific programs and initiatives within Diya City.

What types of activities (NACE) are required to become a Diya City resident – qualified types of activities?

- Development and testing of software, including the publication of computer games.

- Publication and distribution of software, including SaaS.

- Esports.

- Computer literacy training, programming, testing, and technical support of software.

- Cybersecurity.

- R&D in the field of IT and telecom.

- Digital marketing and advertising using software developed by residents.

- Provision of services related to virtual asset circulation.

- Robotics.

- Development, implementation, and support of international card payment system solutions.

- Production of technological products for use in defense, industrial, and domestic sectors.

- Hosting, including cloud data centers.

- Design, production, technical maintenance, and repair of UAVs, along with UAV management training.

Why is legal support for the transition necessary?

Legal support for the transition to the Diya City program is an important element to ensure the successful and effective use of the benefits of this innovative environment. Here are several key aspects for which legal support is necessary:

- Assistance with formal issues related to business registration and legalization of its activities within Diya City.

- Determination of tax benefits and obligations for businesses within the program.

- Protection of intellectual property rights, including patents, trademarks, and copyrights.

- Development and review of contracts with partners, clients, and other stakeholders.

- Assistance in managing HR issues, including employment conditions and employment rules within Diya City.

- Implementation of measures to ensure confidentiality and compliance with data protection rules.

- Provision of legal support in case of conflicts or disputes.

- Advocacy of the company’s interests with government bodies and Diya City structures.

What does the cost of support depend on?

The cost of legal support depends on factors such as:

- Scope of work.

- Specific tasks.

- Project duration.

- Regional peculiarities.

- Individual client requirements.

- Risk factors specific to the project.

If you need legal support for opening a company in Diya City, please contact Dextra Law, whose experts will assist you in addressing legal challenges and ensure a successful start to your business.