Tax Structuring for IT Businesses

In a world of rapid technological change and global competition, IT companies feel the need for not only high-tech solutions but also the development of strategies aimed at optimizing tax obligations and maximizing financial efficiency.

Foreign investors and Ukrainian businesses recognize our tax system for conducting IT business and startup organization as quite attractive. However, the beginning of any venture requires a detailed legal analysis of all options, including the choice of tax burden.

For example, the legal regime of “Dіya.Sіtі” provides the following tax advantages for businesses:

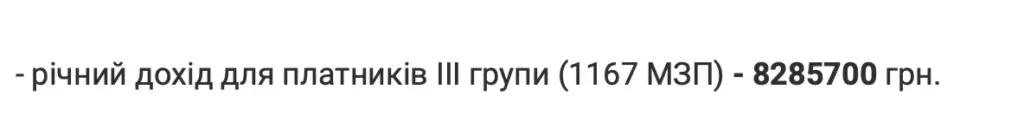

For private entrepreneurs of the 3rd group with the obligation to pay a 5% single tax on income for 2024, the following limits will apply:

For what purposes is IT business structured

Structuring an IT business is carried out to achieve various strategic and operational goals, including:

- Optimization of tax rates. Structuring is aimed at maximizing the benefits of tax incentives and discounts, as well as minimizing overall tax obligations.

- Risk management. Ensuring effective strategies to prevent tax risks and reduce the possibilities of tax disputes.

- Global optimization. For IT companies operating in an international environment, structuring helps optimize tax and legal aspects of operations in different countries. Transfer pricing.

- Cost optimization. Structuring aims to maximize resource utilization and optimize financial and economic indicators.

- Attractiveness for investors. Providing an attractive tax and legal environment for attracting new investments and partners.

- Asset planning. Developing strategies for asset transfer and company control in case of inheritance.

- Protection against legal risks: Structuring to minimize legal risks and ensure compliance with all legal requirements.

- Effective use of tax incentives offered by the “Dіya.Sіtі” regime.

These goals may vary depending on the specific needs and strategies of each IT company. The common goal is to create an efficient and sustainable tax and legal structure that promotes business development and maximizes its potential.

What is included in the complex of tax structuring services:

The complex of tax structuring services includes:

- Providing consultations on structuring IT business;

- Comprehensive legal support for the activities of IT business;

- Selection of a structuring model for IT companies in Ukraine;

- Selection of a tax system for an IT company;

- Tax optimization of IT companies;

- Incorporation of a foreign company;

- Concluding contracts for services with developers;

- Legal support of relations with hired employees.

At what stage should structuring be done

Tax structuring of an IT company should be considered as an integral part of strategic company management, and this can be an important task at different stages of the business life cycle. Let’s consider the key stages at which structuring is recommended:

- Startup. Targeted structuring can help determine the optimal structure for a newly created company, taking into account tax incentives and requirements.

- Expansion and international development. When expanding into new markets or entering international affairs, a review of the tax structure may be required to optimize taxation and consider international tax aspects.

- Tax optimization in case of purchase or merger. In any financial transactions, such as acquisitions or mergers, careful consideration of the tax structure is important for optimizing financial consequences.

- Innovative projects and intellectual property. In the case of the development and implementation of new technologies or intellectual property, structuring can help maximize the benefits of research and development.

- Change of ownership or management. Changes in ownership or company management may require a review of the tax structuring strategy.

- Reorganization and optimization of business processes. During internal reorganizations or business process optimization, it is important to review and adapt the tax structure.

- Tax issue resolution and disputes. In cases of tax issues or disputes with tax authorities, a review and optimization of the structure may be necessary.

- Preparation for sale or IPO. Before selling the company or going public with an IPO, it is important to carefully consider the tax structure.